Health Shield 360 has been relaunched for ICICI Bank customers it focuses on your health & wellness to

prevent hospitalization and incentivizes the customer with rewards to stay

healthy. A 360-degree plan that not only insures you against any eventuality

but also encourages good health and well-being right from the start.

Health Shield 360 is available to ICICI Bank customer

holding savings account. One revolutionary feature in this policy is of uniform

premium amount across all age brackets.

Contents

Health

Shield 360 has following benefits-

Key

Features of ICICI Bank Health Shield 360

Health Shield 360 has following benefits-

·

Comprehensive

·

Competitive

·

Convenient

·

Focus on health

Key Features of ICICI Bank Health Shield 360

Hospitalisation Expenses with High SI Limit - Covers

in-patient hospitalisation expenses, Sum Insured options available from –Rs 10

lakhs to 100 lakhs

Day Care Surgeries/Treatment -All Day Care Treatments &

procedures covered up to SI

Pre and Post-Hospitalisation Expenses - Medical expenses

incurred, immediately, 60 days before and 90 days after hospitalisation

In Patient AYUSH Hospitalisation - AYUSH treatment taken in

AYUSH hospital or AYUSH Day care

Unlimited Reset Benefit - Sum Insured gets reinstated each

time it gets exhausted for a next claim which is not related to previous claim

Additional Sum Insured (Cumulative Bonus) - 10% increase in

sum insured for every claim free year. Max increase in sum insured -100

Home Health care - Covers Home care treatment on advise by

medical practitioner

Claim Protector - Pays claim for non-payable items in claim

such as consumables

Health Check-up Cover - Expense incurred towards the cost of

Health Check-up will be covered every year. Cover changes basis sum insured

Cumulative Bonus Protector (ASI - For any claims upto

₹50,000, NCB earned is protected

Sum Insured Protector -The Sum Insured increases on

cumulative basis at each renewal on the basis of inflation rate in the previous

year

360 Wellbeing Program - Incentivises and rewards individuals

for healthy behaviour through various health and wellbeing activities - Empowers

individuals to manage their lifestyle and be better prepared in preventing

adverse health conditions

Air Ambulance Cover - Expenses incurred for Air Ambulance

services required for emergency care . SI limit upto Sum Insured

Donor Expense - Covers medical expenses in respect of the

donor for organ transplant surgery

Domiciliary Hospitalisation - Covers medical expenses in respect

of domiciliary hospitalisation

PED covered after 30 days - Declared and accepted Pre

Existing Diseases will be covered after 30 days of initial waiting period

Specific Diseases covered after 30 days - 17 named specific

diseases (as mentioned in slide no 15) will be covered in initial waiting

period

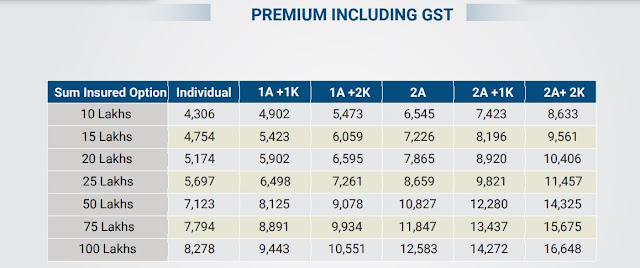

Premium Chart

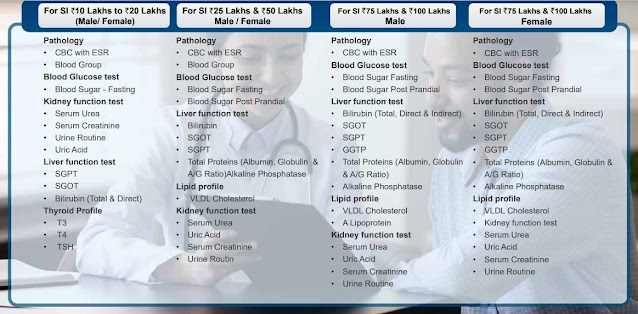

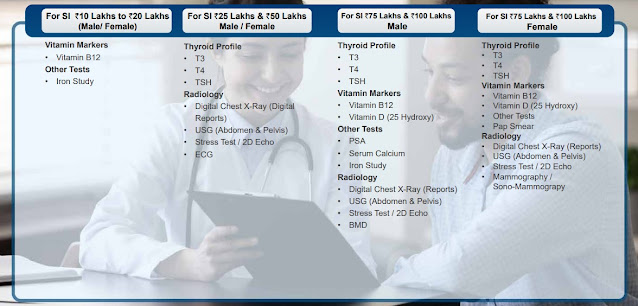

Health Checkup Packages

Eligibility

Exclusive offering to ICICI Bank customers that are insured

members

Tenure 1 Year

Family definition Self, Spouse, Dependent parents, Dependent

siblings and up to 2 dependent children upto 20 years of age

Pre-Policy Medicals Tele underwriting above age 55 years and

also incase of declared Pre-existing disease.Compulsory medicals for Sum

Insured `75 Lakhs and `100 lakhs irrespective of age

Waiting Period

Cooling period 30 days for all diseases except

hospitalization due to accident

Specific exclusions Standard list of diseases &

procedures (kindly refer to exclusion list) will be covered after 30 days

PED AND CONDITIONAL UNDERWRITING

Pre - Existing Disease (PED):

• All declared and accepted PEDs will be covered after 30

days of initial waiting period

• PED needs to be declared by insured for all insured

members in policy

• Any non declaration of PED will lead to rejection of claims

and cancellation of policy

Conditional Underwriting On the basis of insured member’s

age and declared existing illness, a medical underwriting is done for each

proposal. As an outcome of this underwriting the proposal is accepted with

loading on premium or is rejected

Specified disease/ procedure waiting period:

• Any Expenses related to the treatment of Hypertension,

Diabetes, cardiac conditions within 90 days from the first policy start date

• In case of enhancement of sum insured the exclusion shall

apply afresh to the extent of sum insured increase

Major Permanent Exclusions:

• Medical expenses incurred during the first 30 days of

inception of the policy, except those arising out of accidents. This exclusion

doesn’t apply for subsequent renewals without a break

• Expenses attributable to self-inflicted injury (resulting

from suicide, attempted suicide)

• Expenses arising out of or attributable to alcohol or drug

use/ misuse/ abuse

• Cost of spectacles/ contact lenses, dental treatment • Medical

treatment expenses traceable to childbirth (including complicated deliveries

and caesarean sections incurred during Hospitalisation) except ectopic

pregnancy

FAQ

UNLIMITED RESET BENEFIT Reset will be available unlimited

times in a policy year in case the Sum insured including accrued Additional Sum

Insured (if any) and Super No Claim Bonus (if any), Sum Insured protector (if

any) is insufficient as a result of previous claims in that policy year

ADDITIONAL SUM INSURED (CUMULATIVE BONUS)

10% increase in Sum Insured for every claim free renewal in

policy, renewed without any break. Maximum increase in sum insured is 100%

CLAIM PROTECTOR This cover gets the payment for the items

which are not payable under the claim as per the List of Excluded items

released by IRDAI that is related to the particular claim

CUMULATIVE BONUS PROTECTOR(ASI PROTECTOR) insured(ASI) accrued will not be reduced at

renewal if any one claim or multiple claims admissible in Definition the

previous policy year under the policy does not exceed the overall amount of

50,000

SUM INSURED PROTECTOR The Sum Insured protector is designed

to protect the Sum Insured against rising inflation by linking the Sum Insured

under the base plan to the Consumer Price index (CPI

HEALTH CHECK-UP Cost of Health Check-up will be covered as

per specified limit mentioned in policy document

CONDITIONAL UNDERWRITING On the basis of the proposed

insured members age and declared existing illness, a medical underwriting is

done for each proposal. As an outcome of this underwriting the proposal is

accepted with loading on premium or is rejected

How to purchase this plan? In my internet banking,i'm seeing old policy quotes (higher premium) only

ReplyDeleteSir this policy is exclusively for icici bank customer and can be purchased by contacting any ICICI Bank branch still not available online

DeleteDoes it cover Cancer treatment which has 6 - 8 months long duration from initial diagnosis to final radiation therapy?

ReplyDeleteMedical loans for surgery can be a great option to help cover the costs when insurance falls short. It's reassuring to know there are financial solutions available to ensure necessary medical procedures can be accessed by all.

ReplyDeleteNice article! Thank you for this information! I found it very easy and useful!

ReplyDeleteCustom erp software development

Group Policy hai Port bhi nhi hoti

ReplyDeleteAbsolutely loved this post! It's incredibly informative and well-written, providing valuable content and the clarity and depth of the information presented here truly impressed me!

ReplyDeleteCash in Minutes Provo

How much time taken to cover all PED in this policy

ReplyDeleteI just wanted to share my experience with Medical Loans For Surgery, as it's a topic that has had a significant impact on my life. A few years ago, I found myself in a situation where I needed to undergo a major surgical procedure that wasn't covered by my health insurance. The cost was overwhelming, and I was feeling quite hopeless.

ReplyDeleteHands down the best medical insurance I've come across! It provides exceptional coverage and peace of mind, truly a reliable choice for safeguarding health and well-being.

ReplyDelete