ICICI Bank offers Insta OD (Instant over draft) limit to its existing customers who are holding current account and also to new customers not having current account but want to avail Insta OD facility.

Contents

ICICI BANK Insta OD Features –

Benefits of ICICI Bank Insta OD

Eligibility of Insta OD for

existing customers of ICICI Bank -

ICICI Bank Insta OD apply process

for existing customers

ICICI bank insta od interest rate

ICICI Bank Insta OD benefits for

different categories of customers

ICICI Bank Insta OD apply process

for New customer –

What

is INSTA OD ICICI Bank?

Insta OD i.e. Current Account Unsecured Overdraft (CAOD) online platform is developed for Pre-approved ICICI Bank Current Account customers (Individual and Sole Proprietorship Constitution only) for instant disbursements within a few clicks

ICICI

BANK Insta OD Features –

·

Online

Loan Processing

·

Nil

collateral Requirement

·

Minimal

documentation

·

Type

of facility- Overdraft

·

Maximum

facility amount of Rs. 15 lakh

·

Renewable

every 12 months

· No prepayment/foreclosure charges·

Benefits

of ICICI Bank Insta OD

·

Hassle

free processing

·

Assessment

basis banking track record

·

Competitive

interest rate

Eligibility

of Insta OD for existing customers of ICICI Bank -

·

Pre-approved

Individuals and Proprietorships only.

·

Business

vintage of 2 years

·

Current

account vintage of 12 months

·

KYC

complied

· Having valid registered mobile number

ICICI

Bank Insta OD apply process for existing customers

Customers can approach

the online platform from multiple channels like –

·

Corporate

internet banking

·

Insta-Bizz

app

·

SMS

& email campaign

·

ICICI

Bank website

ICICI

bank insta od interest rate

Insta OD Interest is 16%

only on utilized amount

New customers to ICICI Bank

can avail Insta OD facility. It is having following features and advantages –

· Unsecured OD facility

· PF is 2000/lac i.e. 2% of Limit set-up amount

· Interest of 16% only on utilized amount

· No commitment charges

· No fore closure charges

· NCA InstaOD eligible Constitution :

Proprietorship, Partnership and Company

· Maximum Eligible Amount Rs 10,00,000 and

Minimum Amount Rs 50,000

· Nil

Collateral

· Paperless

Processing

· Interest

paid only on the utilized amount

· Act as

a Cheque Protector

· PF is Rs 2000/lac or Rs5/day/lac

ICICI

Bank Insta OD benefits for different categories of customers

Manufacturers

- Stock your Inventory during off season to get better pricing

- Protection against cheque bounce

- Improve Payment history

- Avail cash discount by paying upfront

Services

- Improve Payment History

- Meet sudden exigencies without impacting working capital

- Protection against cheque bounce

Traders

- Protection against cheque bounce

- · Improve Payment history

- · Stock during off season to get better pricing

- · Avail cash discount by paying upfront

ICICI

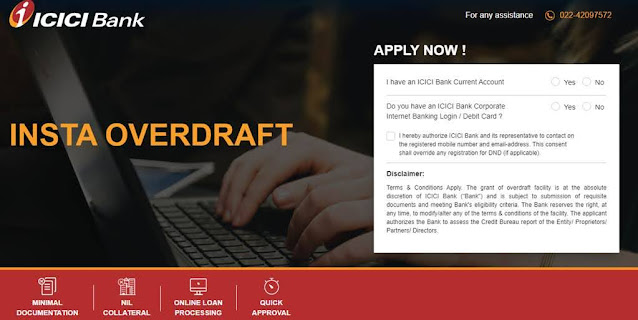

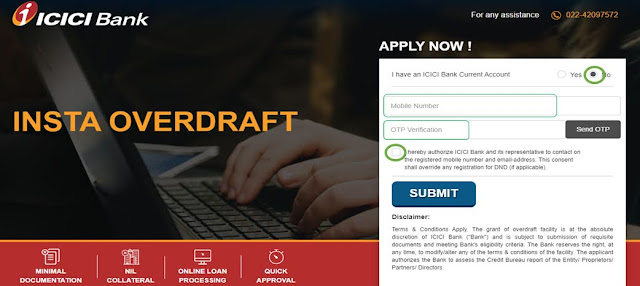

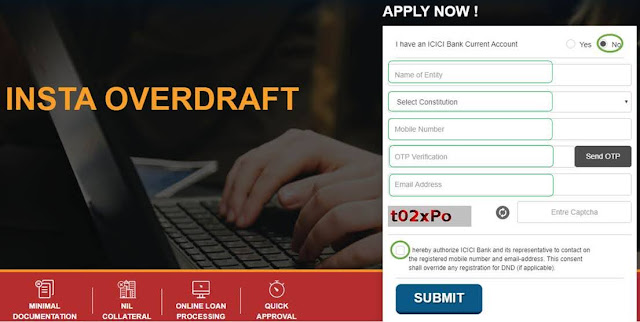

Bank Insta OD apply process for New customer –

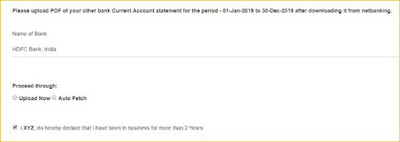

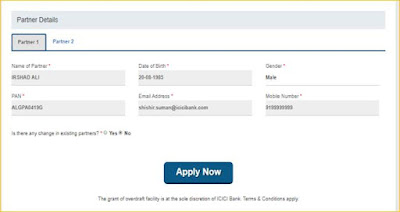

ICICI Bank insta od

login New customers can login to https://clos.icicibank.com/CAOOD/Apply.jsp

for initiating

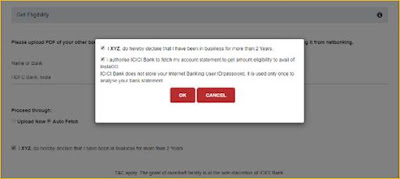

Click on OK option to get eligibility

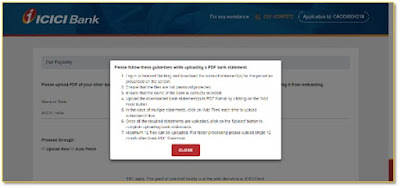

Upload 12 months latest PDF bank statement basis other bank

Please note the

following before uploading the statement.

• Statement

should be in PDF format.

• Statement

should not be password protected.

• Statement

should not be pdf converted from word or excel.

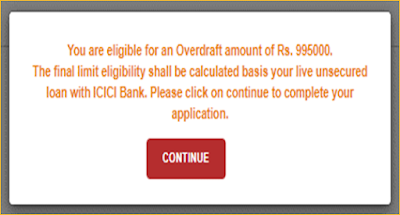

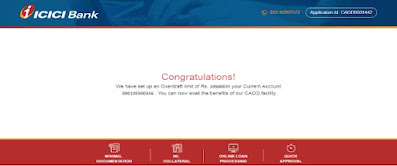

Straight Through Process- In this case manual intervention is not required and disbursement takes place instantly as per below message

Thanks for sharing this curtail information with us, its helpful:)

ReplyDeleteCash in Minutes