Contents

Can an NRI apply for credit card?

Can NRI get a ICICI credit card in India?

Who is eligible for ICICI credit card?

Maximum and minimum Credit Limit for ICICI Bank NRI Credit Card

Documentation

Auto Debit

Other important things to note about NRI Credit Card ICICI Bank

ICICI NRI credit card against FD

Eligibility

Joining and Annual Fee

Credit Card Usage (Spends)

Features of NRI Coral Credit Card against Fixed Deposit

Can an NRI apply for credit card?

NRI credit cards are credit cards specifically designed for non-resident Indians (NRIs), who are Indian citizens living and working abroad. These credit cards are typically offered by banks in India and are targeted at NRIs who have a steady income and want to maintain a good credit score while living abroad.

To apply for an NRI credit card, you typically need to have a valid passport and a valid Indian address, as well as proof of your income and employment status. You may also need to provide proof of your NRI status, such as an Overseas Citizen of India (OCI) card or a Person of Indian Origin (PIO) card.

Can NRI get a ICICI NRI credit card in India?

NRI can avail credit card facility in India with ICICI Bank NRI account. On Resident Indians (NRIs) have to pay mark-up amount to make domestic transaction from their International Credit Card. With NRI Credit Cards, NRIs can make domestic transactions without any extra charges.

These Credit Cards will be linked with NRE/NRO Savings account along with mandatory Auto Debit Facility. We are not enabling the feature to use this card internationally and transactions can be made only in India (transaction currency: INR and Merchant Registered Country: INDIA). Credit Card Bill Payment will be done by Auto Debiting the NRE/NRO (whichever is linked) account for Total Amount Due (TAD) on the payment due date. In case the due date falls on a Sunday or a holiday

Who is eligible for ICICI credit card?

1. First eligibility criteria is NRI should be having NRE/NRO account with ICICI Bank. All Non- Resident Indian (NRI) customers having a Pre-Qualified (PQ) Offer generated against their NRE/NRO Savings account are eligible for the card

2. Minimum age of the applicant should be 25 years Maximum age for salaried applicant should be 58 years and for self-employed applicant should be 65 years

3. Only individual applicants will be eligible

4. Only primary account holders will be eligible

Maximum and minimum Credit Limit for ICICI Bank NRI Credit Card

Minimum credit limit will be INR 50,000 and maximum credit limit cap will be at INR 3, 00,000

Documentation

• Know Your Customer (KYC) norms applicable as per regulatory guidelines

• Copy of valid Indian passport with photo and signature

• Copy of valid visa/work permit/resident card

• Overseas residence address proof

Auto Debit

Applicants should compulsorily opt for auto debit with total amount due (TAD) as payment mode

Other important things to note about NRI Credit Card ICICI Bank

• Transactions will be allowed only within India

• Only INR denominated transactions will be allowed

• Students and housewives are not eligible under this program

ICICI NRI credit card against FD

For NRI not having any Pre Qualified offers in their NRE / NRO account can opt for secured credit cards offered against the NRI Fixed deposits

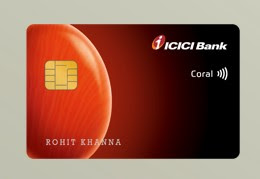

ICICI Bank NRI Coral Credit Card against Fixed Deposit

Eligibility

Minimum Fixed Deposit of Rs 1,00,000

• Minimum Fixed Deposit tenure of 180 days

• Partially withdrawn Fixed Deposit not eligible

• Individual NRE/NRO FDs are eligible

• FDs against which lien has already been marked are not eligible

• Joint FDs are not eligible Credit Limit

• Credit limit will be 75% of the Fixed Deposit amount with a maximum limit of Rs 5,00,000

• Auto debit is mandatory from NRE/NRO Savings account. Credit Card Bill Payment will be done by Auto Debiting NRE/NRO (whichever is linked) account for the Total Amount Due (TAD) on the card.

Joining and Annual Fee

• Joining Fee: Rs 500

• Annual Fee: Rs 500

• Annual Fee will be waived if spends in the previous year cross Rs 1,50,000

Credit Card Usage (Spends)

• ICICI Bank NRI Coral Credit Card against Fixed Deposit can be used for domestic transactions (transaction currency: INR and Merchant Registered Country: INDIA) only

Features of NRI Coral Credit Card against Fixed Deposit

Movie Tickets

• BookMyShow offer: Avail of 25% discount up to INR 100 on purchase of minimum two tickets up to two times in a month on BookMyShow subject to quota

Domestic Airport Benefits

• 1 complimentary domestic airport lounge accesses per quarter by spending minimum of INR 5,000 or above in a calendar quarter on the card to avail this facility in the next calendar quarter

Reward Points

• 2 ICICI Bank Reward Points earned on every Rs 100 spent on card (except fuel), and 1 ICICI Bank Reward Point earned on every Rs 100 spent on utilities and insurance categories

Dining

• Exclusive dining offers through the ICICI Bank Culinary Treats Program Fuel

• 1% Fuel Surcharge Waiver on fuel purchases at HPCL petrol pumps when card is swiped at ICICI Bank POS terminals

FAQ

Who can apply for this credit card?

Indian citizens who are living in foreign countries can apply for this credit card.

What is the annual fee on this credit card?

The annual fee on this credit card is Rs. 500 + GST.

Is there annual fee waiver offered on ICICI Bank NRI Coral credit card?

Yes, users do not have to pay annual fees if their annual spends exceed Rs. 1.50 lakh.

Do I have to get the supplementary card?

Yes, it is mandatory to get a supplementary credit card in order to use this credit card

Nice one

ReplyDeleteThanks for making blog on ICICI bank NRI credit card features, you did a great job on this article, it really helpful for me! keep it up...

ReplyDeleteCash in Minutes

Very informative post! There is a lot of information about credit card and it's useful stuff.

ReplyDeleteInventory Management Software

Apply for udyam certificate via official udyam registration portal in an easy and hassle-free manner with the best consultancy by our experts.

ReplyDelete